Electroless Plating Market

Electroless Plating Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_703254 | Last Updated : August 01, 2025 |

Format : ![]()

![]()

![]()

![]()

Electroless Plating Market Size

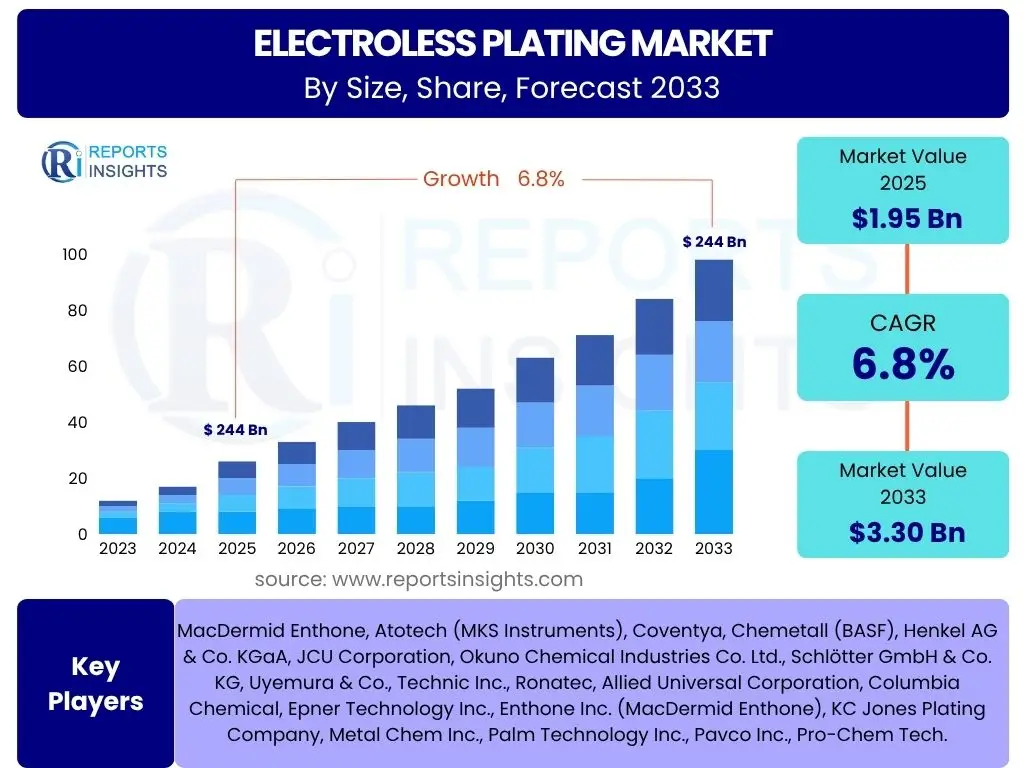

According to Reports Insights Consulting Pvt Ltd, The Electroless Plating Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2033. The market is estimated at USD 1.95 Billion in 2025 and is projected to reach USD 3.30 Billion by the end of the forecast period in 2033.

Key Electroless Plating Market Trends & Insights

Users frequently inquire about the evolving landscape of the electroless plating market, seeking to understand the innovations and shifts that are shaping its future. A primary theme revolves around the increasing adoption of sustainable plating solutions, driven by stricter environmental regulations and growing corporate social responsibility. Another significant area of interest is the continuous development of advanced composite coatings and the integration of smart manufacturing principles to enhance process efficiency and product quality. The market is also witnessing a demand for tailor-made plating solutions catering to highly specialized applications, moving beyond conventional requirements.

Furthermore, there is keen interest in the expansion of electroless plating into novel applications, particularly within the electronics, automotive, and aerospace sectors where lightweighting, durability, and precise functional coatings are paramount. The digital transformation of manufacturing processes is also influencing the market, with an emphasis on data-driven process control and predictive analytics to optimize plating baths and reduce waste. These trends collectively underscore a market moving towards greater efficiency, sustainability, and application diversity, responding to both technological advancements and evolving industrial demands.

- Growing demand for sustainable and eco-friendly plating solutions to comply with stringent environmental regulations.

- Increased adoption of advanced composite electroless coatings for enhanced performance properties like wear resistance and corrosion protection.

- Miniaturization in electronics driving demand for uniform, precise, and thin-film coatings for printed circuit boards and semiconductors.

- Expansion into new applications such as electric vehicle components, additive manufacturing parts, and medical devices requiring highly specialized surface finishes.

- Integration of smart manufacturing and automation in plating lines to improve efficiency, reduce operational costs, and ensure consistent quality.

AI Impact Analysis on Electroless Plating

Common user questions regarding AI's influence on electroless plating often center on how artificial intelligence can optimize complex chemical processes, predict material performance, and enhance quality control. Users are keen to understand if AI can lead to more stable bath compositions, reduce chemical consumption, and minimize waste generation. The primary expectation is that AI will provide predictive capabilities for process parameters, thereby preventing defects, improving yield rates, and reducing the need for extensive manual adjustments. This aligns with the broader industry drive towards smarter, more autonomous manufacturing systems.

Moreover, there are questions about AI's role in data analysis, particularly how it can process large datasets from sensors and lab analyses to identify correlations and optimize plating parameters beyond human capabilities. The potential for AI to facilitate real-time monitoring and anomaly detection is also a significant area of user interest, aiming for continuous improvement in plating consistency and reliability. While the technology is still nascent in this highly specialized field, the consensus among users is that AI holds substantial promise for transforming electroless plating into a more efficient, precise, and environmentally conscious process, addressing long-standing industry challenges related to variability and resource intensity.

- Process Optimization: AI algorithms can analyze real-time data from plating baths (temperature, pH, concentration) to predict optimal parameters, ensuring stable and efficient deposition.

- Quality Control: Machine learning models can detect subtle defects or inconsistencies in plated surfaces, improving product quality and reducing rejection rates.

- Predictive Maintenance: AI can forecast equipment failures or bath depletion, allowing for proactive maintenance and reducing downtime, thereby improving operational efficiency.

- Recipe Optimization: AI can explore vast parameter spaces to identify novel plating formulations or optimize existing ones for desired material properties, accelerating R&D.

- Resource Efficiency: By optimizing chemical usage and reducing waste through precise process control, AI contributes to more sustainable and cost-effective operations.

- Automated Inspection: AI-powered vision systems can perform rapid and accurate inspection of plated components, significantly speeding up the quality assurance process.

Key Takeaways Electroless Plating Market Size & Forecast

Users frequently inquire about the most critical aspects derived from the electroless plating market size and forecast, seeking concise insights into its growth trajectory and underlying dynamics. A key takeaway is the consistent and robust growth projected for the market, driven by its indispensable role in high-performance applications across diverse industries. The forecast highlights a shift towards more specialized and high-value coatings, moving beyond traditional applications to address evolving demands in sectors like electronics, automotive, and aerospace where precision and functional superiority are paramount. This sustained expansion underscores the technology's inherent advantages in delivering uniform, conductive, and corrosion-resistant layers without external electricity.

Another significant insight revolves around the increasing emphasis on technological innovation and environmental compliance as pivotal growth enablers. The market's future expansion is heavily reliant on the development of new, environmentally benign formulations and processes that meet stringent regulatory requirements. Furthermore, the forecast indicates that while established regions will continue to be significant revenue contributors, emerging economies are poised to exhibit accelerated growth due to rapid industrialization and increasing manufacturing capabilities. Ultimately, the market's trajectory reflects its adaptability and critical importance in providing advanced surface finishing solutions essential for modern industrial components.

- The electroless plating market is poised for steady growth, driven by increasing demand for advanced surface finishing solutions across diverse industries.

- Technological advancements in composite coatings and sustainable plating processes are key accelerators for market expansion.

- Asia Pacific is expected to maintain its dominance and exhibit the highest growth rate due to robust industrialization and electronics manufacturing.

- The automotive and electronics industries will remain primary end-users, with significant growth stemming from electric vehicles and miniaturized electronic components.

- Regulatory pressures concerning hazardous chemicals are fostering innovation towards eco-friendly and chrome-free plating solutions, impacting market direction.

Electroless Plating Market Drivers Analysis

The electroless plating market is experiencing significant growth propelled by several key drivers. The escalating demand from the automotive and electronics industries for enhanced surface properties, such as corrosion resistance, wear resistance, and conductivity, is a primary catalyst. As these sectors innovate with lighter materials and more complex components, the need for precise and uniform coating becomes paramount, a requirement perfectly met by electroless plating processes. Furthermore, the push for miniaturization in electronic devices necessitates coatings that can be applied with exceptional precision and consistency on intricate geometries. This inherent capability of electroless plating positions it as an indispensable technology for advanced manufacturing, fostering widespread adoption across various high-tech applications globally.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Demand from Automotive Industry | +1.5% | North America, Europe, Asia Pacific (China, India) | 2025-2033 |

| Growth of Electronics and Semiconductor Sector | +1.2% | Asia Pacific (South Korea, Taiwan, Japan), North America | 2025-2033 |

| Rising Need for Corrosion and Wear Resistance | +1.0% | Global | 2025-2033 |

| Advancements in Material Science and Engineering | +0.8% | Global | 2027-2033 |

| Strict Environmental Regulations Pushing for Advanced Coatings | +0.7% | Europe, North America | 2026-2033 |

Electroless Plating Market Restraints Analysis

Despite its significant advantages, the electroless plating market faces certain restraints that could impede its growth. One major concern is the high initial capital investment required for setting up and maintaining electroless plating facilities, which includes specialized equipment, chemical handling systems, and waste treatment infrastructure. This can be a significant barrier for new entrants or smaller businesses. Additionally, the increasing stringency of environmental regulations regarding the disposal of chemical waste generated during the plating process poses a considerable challenge. Compliance with these regulations often incurs substantial operational costs and requires sophisticated waste management solutions, impacting the overall profitability and scalability of plating operations. These factors collectively necessitate careful planning and investment in sustainable practices to mitigate their limiting effects on market expansion.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| High Initial Investment and Operational Costs | -0.9% | Global | 2025-2033 |

| Stringent Environmental Regulations and Waste Management | -1.1% | Europe, North America, parts of Asia Pacific | 2025-2033 |

| Competition from Alternative Coating Technologies | -0.7% | Global | 2025-2033 |

Electroless Plating Market Opportunities Analysis

The electroless plating market is presented with several promising opportunities that are set to drive its future expansion. The rapid growth of the electric vehicle (EV) sector offers a substantial avenue for electroless plating, as these vehicles require specialized coatings for battery components, connectors, and power electronics to enhance performance, thermal management, and durability. Similarly, the burgeoning field of additive manufacturing, or 3D printing, creates demand for post-processing techniques like electroless plating to improve surface finish, provide conductivity, or enhance corrosion resistance of printed parts. These emerging applications represent new frontiers for electroless plating technology, leveraging its unique capabilities to meet novel industrial requirements. Furthermore, continuous research and development into new composite materials and advanced plating chemistries are creating opportunities for innovative solutions that can address previously unmet needs, fostering diversification and opening up new revenue streams for market players.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Growth in Electric Vehicle (EV) Components | +1.3% | Global, particularly Asia Pacific (China), Europe, North America | 2025-2033 |

| Expansion in Additive Manufacturing (3D Printing) Post-Processing | +1.0% | North America, Europe | 2026-2033 |

| Development of Sustainable and Environmentally Friendly Processes | +0.9% | Europe, North America, leading Asian economies | 2025-2033 |

Electroless Plating Market Challenges Impact Analysis

The electroless plating market faces several challenges that require innovative solutions and strategic adaptation. One significant challenge is the inherent complexity of process control in electroless plating, where maintaining precise chemical bath concentrations, temperature, and pH levels is crucial for consistent quality and performance. Any deviation can lead to defects, increased rework, and material waste, impacting profitability. Furthermore, the market grapples with the management and disposal of hazardous waste generated by certain plating chemicals, which not only entails high compliance costs but also presents significant environmental liabilities. The fluctuating raw material prices, particularly for key metals like nickel and copper, also pose a challenge, affecting the cost-effectiveness and pricing stability of plating services and products. Overcoming these challenges will necessitate continuous investment in automation, advanced analytical tools, and sustainable chemical alternatives to ensure the market's long-term viability and growth.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Complexity of Process Control and Quality Consistency | -0.8% | Global | 2025-2033 |

| Management and Disposal of Hazardous Waste | -1.0% | Global, especially developed economies | 2025-2033 |

| Volatility in Raw Material Prices | -0.6% | Global | 2025-2033 |

Electroless Plating Market - Updated Report Scope

This report provides an in-depth analysis of the global Electroless Plating Market, offering comprehensive insights into its current state, historical performance, and future growth projections. It meticulously examines market dynamics, including key trends, drivers, restraints, opportunities, and challenges, providing a holistic view for stakeholders. The scope covers detailed segmentation by plating type, substrate material, application, and end-use industry, alongside an extensive regional analysis to highlight geographical nuances and growth pockets. Furthermore, the report profiles leading market players, assessing their strategies and competitive landscape to offer strategic guidance for market participants.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 3.30 Billion |

| Growth Rate | 6.8% |

| Number of Pages | 257 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | MacDermid Enthone, Atotech (MKS Instruments), Coventya, Chemetall (BASF), Henkel AG & Co. KGaA, JCU Corporation, Okuno Chemical Industries Co. Ltd., Schlötter GmbH & Co. KG, Uyemura & Co., Technic Inc., Ronatec, Allied Universal Corporation, Columbia Chemical, Epner Technology Inc., Enthone Inc. (MacDermid Enthone), KC Jones Plating Company, Metal Chem Inc., Palm Technology Inc., Pavco Inc., Pro-Chem Tech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The electroless plating market is meticulously segmented to provide a detailed understanding of its diverse components and their respective contributions to the overall market landscape. This comprehensive segmentation allows for an granular analysis of various plating types, the wide array of substrate materials, the multifaceted applications served, and the extensive range of end-use industries that rely on electroless plating solutions. Each segment and sub-segment plays a crucial role in shaping market dynamics, driven by specific technological needs, material compatibility, and industrial requirements. The detailed breakdown highlights the versatility and adaptability of electroless plating technology across different verticals, revealing key areas of growth and innovation within the industry.

- By Type:

- Electroless Nickel Plating (EN) including variations like High Phosphorus, Medium Phosphorus, Low Phosphorus, Nickel-Boron.

- Electroless Copper Plating (ECP) for Printed Circuit Boards (PCBs) and electromagnetic interference (EMI) shielding.

- Electroless Gold Plating (EGP) for electronics and decorative applications.

- Electroless Silver Plating for reflectivity and conductivity.

- Electroless Cobalt Plating for magnetic and wear-resistant applications.

- Electroless Composite Plating incorporating materials like PTFE, ceramic particles (SiC, Al2O3), or diamond for enhanced properties.

- Other Electroless Plating Types including Sn, Pd, and various alloys.

- By Substrate Material:

- Metals such as Steel, Aluminum, Copper Alloys, Zinc, and Magnesium.

- Plastics including ABS (Acrylonitrile Butadiene Styrene), Polycarbonate, and Polyamide.

- Ceramics for specialized high-temperature or wear-resistant applications.

- Composites like carbon fiber reinforced polymers (CFRP) and glass fiber reinforced polymers (GFRP).

- Others, encompassing glass, graphite, and other non-conductive materials.

- By Application:

- Corrosion Resistance for protecting components in harsh environments.

- Wear Resistance to extend the lifespan of moving parts and tools.

- Conductivity and EMI Shielding for electronic components and enclosures.

- Decorative Coatings for aesthetic enhancement.

- Solderability for electronic assembly.

- Lubricity for reducing friction in mechanical systems.

- Others, including hardness enhancement, non-magnetic properties, and reflectivity.

- By End-Use Industry:

- Automotive, encompassing engine parts, brake systems, fuel systems, and electrical connectors.

- Electronics, covering Printed Circuit Boards (PCBs), semiconductors, connectors, and consumer electronics.

- Aerospace & Defense, for turbine blades, landing gear components, and satellite parts.

- Oil & Gas, used for valves, pumps, downhole tools, and pipelines.

- Medical & Healthcare, including surgical instruments, medical devices, and implants.

- Chemical Processing, for pumps, valves, tanks, and chemical reactors.

- Machinery & Equipment, involving industrial tools and manufacturing equipment.

- Consumer Goods, for household appliances, sporting goods, and jewelry.

- Others, such as marine, power generation, and construction.

Regional Highlights

- North America: This region maintains a significant share in the electroless plating market, driven by robust growth in the aerospace and defense sectors, coupled with increasing demand from the automotive industry, particularly for electric vehicle components. The presence of key market players and a strong focus on research and development contribute to technological advancements. Stringent environmental regulations in the U.S. and Canada are also pushing for the adoption of more sustainable and efficient plating processes, fostering innovation in eco-friendly solutions.

- Europe: Europe is a mature market for electroless plating, characterized by stringent environmental norms and a strong emphasis on industrial manufacturing, particularly in Germany, France, and the UK. The automotive industry, including the rapidly expanding EV segment, alongside the general engineering and electronics sectors, are key demand drivers. The region is also at the forefront of developing advanced and sustainable plating technologies, ensuring compliance with regulations like REACH and promoting resource efficiency.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the electroless plating market, primarily due to rapid industrialization, burgeoning electronics manufacturing, and a thriving automotive industry in countries like China, Japan, South Korea, and India. The high volume production of consumer electronics, printed circuit boards, and semiconductors in this region significantly fuels the demand for electroless copper and nickel plating. Furthermore, increasing foreign investments and expanding manufacturing bases are contributing to the robust growth trajectory.

- Latin America: The market in Latin America is witnessing steady growth, largely influenced by the expansion of the automotive and general manufacturing sectors, particularly in Brazil and Mexico. The region’s growing industrial base requires reliable surface finishing solutions, creating opportunities for electroless plating. While environmental regulations are evolving, there is a growing awareness and adoption of more efficient plating technologies to meet rising quality standards and global supply chain requirements.

- Middle East and Africa (MEA): The MEA market for electroless plating is expected to grow moderately, driven by investments in the oil and gas industry, infrastructure development, and growing manufacturing capabilities in countries such as Saudi Arabia, UAE, and South Africa. The need for corrosion-resistant coatings in harsh operating environments, particularly in the energy sector, is a key demand driver. Opportunities also arise from diversification efforts in various economies, leading to the development of new industrial segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electroless Plating Market.- MacDermid Enthone

- Atotech (MKS Instruments)

- Coventya

- Chemetall (BASF)

- Henkel AG & Co. KGaA

- JCU Corporation

- Okuno Chemical Industries Co. Ltd.

- Schlötter GmbH & Co. KG

- Uyemura & Co.

- Technic Inc.

- Ronatec

- Allied Universal Corporation

- Columbia Chemical

- Epner Technology Inc.

- Enthone Inc. (MacDermid Enthone)

- KC Jones Plating Company

- Metal Chem Inc.

- Palm Technology Inc.

- Pavco Inc.

- Pro-Chem Tech

Frequently Asked Questions

Analyze common user questions about the Electroless Plating market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is electroless plating?

Electroless plating, also known as auto-catalytic plating, is a non-galvanic plating method that involves depositing a metallic coating onto a substrate without the use of an external power source. The process relies on a chemical reduction reaction in an aqueous solution, which is catalyzed by the surface of the substrate itself, resulting in a uniform and highly conformal coating.

What are the primary advantages of electroless plating over electrolytic plating?

Electroless plating offers several key advantages, including superior uniformity of coating thickness, even on complex geometries and internal surfaces, due to its currentless nature. It also provides excellent corrosion resistance, enhanced hardness, and improved wear properties. Furthermore, it can plate non-conductive substrates with proper pre-treatment, which is not possible with electrolytic plating.

What are the main applications of electroless plating?

Electroless plating is widely used across various industries for diverse applications. Key sectors include electronics (for printed circuit boards, connectors, and semiconductor components), automotive (for engine parts, brake systems, and fuel injection systems), aerospace and defense (for turbine blades and landing gear), oil and gas (for valves, pumps, and downhole tools), and medical (for surgical instruments and implants), primarily for corrosion resistance, wear resistance, conductivity, and decorative purposes.

What are the key types of electroless plating in the market?

The most common types of electroless plating are Electroless Nickel (EN) plating, which can be high, medium, or low phosphorus for varying properties like hardness and corrosion resistance, and Electroless Copper (ECP) plating, crucial for printed circuit board manufacturing. Other types include electroless gold, silver, cobalt, and various composite platings that incorporate additional particles for enhanced functional properties.

What are the environmental concerns associated with electroless plating and how are they being addressed?

Environmental concerns primarily revolve around the disposal of spent plating baths containing heavy metals and complexing agents, which can be hazardous. The industry is addressing these by developing more sustainable and eco-friendly formulations, implementing advanced wastewater treatment technologies, and exploring recycling and recovery methods for plating chemicals. Regulatory pressures are also driving the shift towards chrome-free and other less toxic alternatives.